Warren Buffett vs. Vanguard: The Best Investment Strategy for Long-Term Wealth

Warren Buffett vs. Vanguard: The Best Investment Strategy for Long-Term Wealth

- 1 Warren Buffett vs. Vanguard: The Best Investment Strategy for Long-Term Wealth

Introduction

Hello, this is Maegami, author of the blog Goddess’ Bangs.

Have you started investing yet? Since the “20 million yen retirement savings problem” was raised in Japan, more young people have begun exploring investments. I’m also investing myself, mainly for building retirement assets.

I studied it during the pandemic

Today, let’s explore Warren Buffett’s investment style and Vanguard’s index fund approach, and see which works best for long-term financial growth.

What Is Investing?

Investing means putting money into companies, people, or projects that are expected to generate profits, and in return, growing your wealth.

Some think investing is gambling, but that’s not true. The key is choosing the right type of investment.

Investments to Avoid

Unless you have strong knowledge, avoid these risky strategies:

Trusting Others Blindly

Never invest just because someone recommends it.

Giving Money to Others to Manage

If you don’t control your own funds, you risk losing them completely.

Betting Only on Unstable Assets

FX or cryptocurrencies like Bitcoin can fluctuate wildly.

Investing by Intuition Alone

For example: “I like this brand’s clothes, so I’ll buy its stock.”

Hedge Funds Without Knowledge

Short-term profit-focused funds require expertise.

Vanguard and John Bogle (H2)

Founded in 1975 by John Bogle, Vanguard is one of the largest investment companies in the world. Bogle also created the index fund, which changed investing forever.

H3: What Is an Index Fund?

An index fund tracks a market index, such as the S&P 500, which includes 500 leading U.S. companies.

- Low-cost

- Diversified

- Long-term growth potential

With index funds, you don’t need to pick individual stocks—you invest in the entire market.

Warren Buffett’s Investment Strategy

The world’s most famous investor, Warren Buffett, chairman of Berkshire Hathaway, built his fortune by analyzing companies deeply.

How Buffett Chooses Stocks

- Debt ratio

- Growth potential

- Management quality

- Company philosophy

- Employee attitude

His teacher, Benjamin Graham, shaped his value investing style. Buffett stresses patience, discipline, and ignoring short-term market noise.

Mutual Funds vs. Index Funds

A mutual fund pools money from investors and is managed by professionals.

- ✅ Advantage: Diversification with small amounts

- ❌ Disadvantage: Higher management fees

In contrast, index funds like Vanguard’s offer much lower costs—making them ideal for long-term investors.

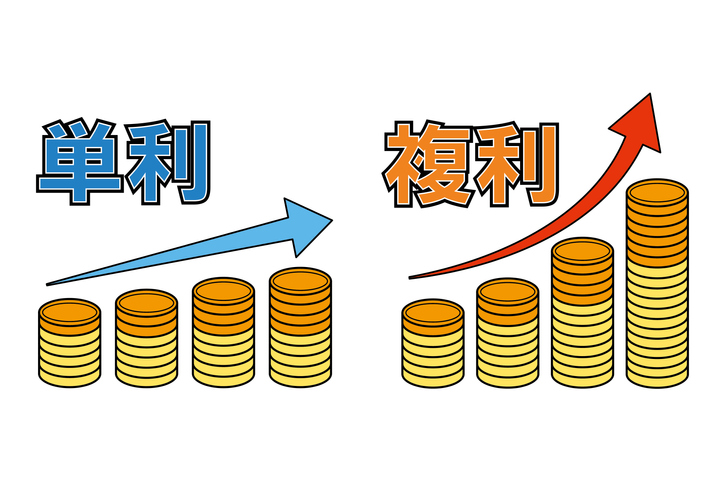

The Power of Compound Interest

Compound interest means earning returns not just on your initial investment, but also on accumulated profits.

Albert Einstein called it the “eighth wonder of the world.” Warren Buffett’s fortune grew exponentially thanks to compounding—especially as he aged.

👉 The earlier you start, the greater the growth.

Long-Term Investing and Risks

Markets fluctuate, but U.S. stocks have historically grown over the past 100 years.

- Short-term = volatility

- Long-term = growth

To reduce risk:

- Diversify investments

- Keep emergency savings

- Be prepared for downturns

Conclusion

Both Warren Buffett and Vanguard highlight the importance of long-term discipline.

- Buffett teaches the power of careful company analysis.

- Vanguard makes investing accessible and affordable through index funds.

Start early, invest steadily, and let compound interest grow your wealth.